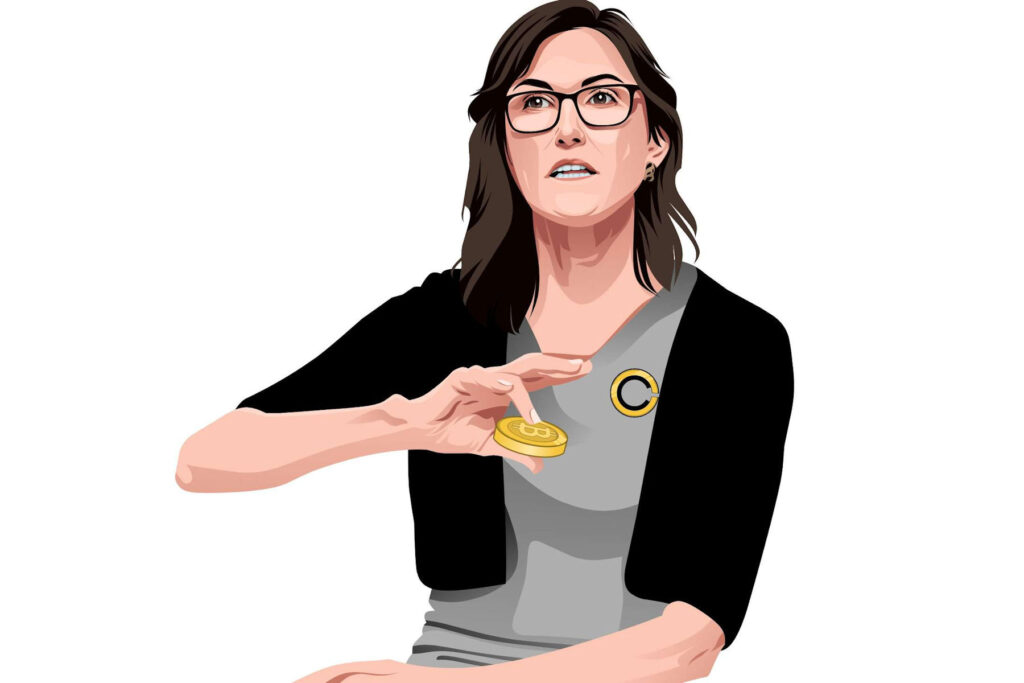

In a recent Tweet, ARK Invest CEO Cathie Wood reiterated the stability of particular digital wallets and blockchain technology among the current uncertainty surrounding the crypto industry.

Wood argued that these innovative technologies are among those that the equity market largely ignored in 2022. Despite their growing impact on the economy, experts focused mainly on inflation rather than the opportunities found in “innovation disruption.”

The Stability of Digital Wallets

According to Cathie Wood, digital wallets are quickly replacing cash and credit cards as the top transaction method for offline commerce. In 2020, digital wallets overtook cash as the leading method for offline transactions.

By 2021, they accounted for approximately 50% of global online commerce. Wood suggests that investors should not overlook the potential of digital wallets in the current market climate.

In addition to digital wallets, Wood also highlighted the potential of public blockchains like Bitcoin and Ethereum. Despite the recent collapse of the crypto exchange FTX, Wood noted that public blockchains have not skipped a beat in processing transactions.

The implosion of FTX may have even educated crypto investors in critical areas. These include being more diligent with where they store their assets and the option for trading on decentralized exchanges. These platforms permit sales and purchases without a central intermediary Overall activity on these exchanges has recently increased by 37%.

Potential in Disruptive Technologies

Despite the uncertainty in the market, Wood believes that “disruptive technologies” have historically “gained share during turbulent times.” She noted other “game-changing” innovations that the equity market largely ignored in 2022. These included artificial intelligence, electric vehicles, space exploration, and 3D printing.

Overall, Cathie Wood suggests that the current market conditions present an opportunity for investors to take advantage of emerging technologies. With fears of entrenched inflation and higher interest rates, investors may be holding high levels of cash not seen since the 9/11 crisis in 2001.

However, Wood believes that technologies that solve problems, such as digital wallets and public blockchains, have the potential to gain market share in the current climate.